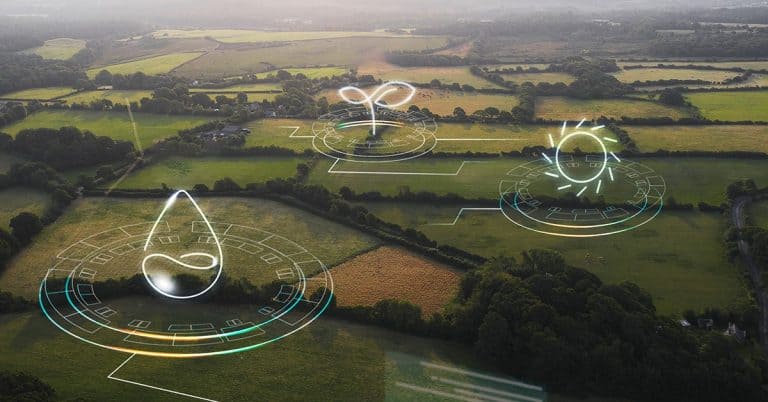

Carbon capture and climatech represent an exciting frontier in technology that can help us fight climate change. However, developing and deploying these technologies at scale is expensive, making it difficult for startups and entrepreneurs to bring their ideas to market. One potential solution to this problem is crowdfunding, which allows individuals to pool their resources and invest in promising projects. Examine the potential for crowdfunding to finance carbon capture and climatech projects and learn about the opportunities available for retail investors, as well as the successful crowdfunding campaigns.

How carbon capture and climatech crowdfunding is beneficial?

Carbon capture and climatech represent an exciting frontier in technology that can help us fight climate change.

However, developing and deploying these technologies at scale is expensive, making it difficult for startups and entrepreneurs to bring their ideas to market.

One potential solution to this problem is crowdfunding, which allows individuals to pool their resources and invest in promising projects. But how exactly does it work? What are the opportunities that it brings?

First, let’s define our terms. Carbon capture is a set of technologies that capture carbon dioxide emissions from power plants and industrial processes, preventing them from entering the atmosphere and contributing to climate change.

Climatech, on the other hand, encompasses a wide range of technologies that can help us adapt to a changing climate, such as renewable energy, water conservation, and sustainable agriculture.

Both of these areas have seen increasing interest from investors in recent years, including through crowdfunding platforms. These platforms allow a variety of investors to contribute to the project, in a somewhat easier way than traditional business practices.

One of the advantages of crowdfunding is that it allows small-scale investors to participate in projects that might otherwise be out of reach. Furthermore, crowdfunding offers competition for the availability of investments and funding to carbon capture and climatech projects.

While traditional venture capital and institutional investors tend to focus on larger, later-stage startups, crowdfunding can provide early-stage financing for innovative ideas and technologies.

This can be particularly valuable for carbon capture and climatech, which are still emerging fields with significant potential for growth.

The current circumstances demand quick action. And some of the large corporations might be more interested in types of investment that bring financial benefits rather than supporting initiatives that take time and effort.

Crowdfunding allows retail investors to put pressure on large corporations while supporting projects with the highest potential.

Moreover, crowdfunding can also have an educational effect on the masses. In other words, small investors gain insight into technological advancements and green energy initiatives through investment in crowdfunding projects.

This also provides people with more experience in shaping investment landscapes and getting involved with community initiatives with environmental protection in mind.

Finally, crowdfunding can offer retail investors increased transparency about the investment process. Investment platforms can provide necessary information and updates about the progress by the startups, disclosure of financial reports, and the possibility to participate in community discussion groups related to the project.

This approach ensures that small investors are entirely informed about the investment’s progress and management. Additionally, this helps investors make informed investment decisions.

But what are the successful carbon capture and climatech crowdfunding campaigns and the platforms available?

Successful carbon capture and crowdfunding campaigns and platforms

Research shows there are already successful crowdfunding campaigns for carbon capture and climatech projects.

An example of a successful one is Swiss startup Climeworks, which raised €15.8 million through a series of crowdfunding drives to establish the world’s largest CO2 removal system.

Consequently, the network of investors looking for green investment opportunities is growing fast, and crowdfunding campaigns focused on carbon capture and climatech projects can promise a substantial return in the long run.

As for platforms, there are several crowdfunding platforms that specialize in environmental and sustainability projects, such as Abundance Investment and Trine.

These platforms offer retail investors the chance to invest in projects such as wind farms, solar power plants, and energy-efficient buildings.

While these projects may not be specifically focused on carbon capture or climatech, they do represent a way to invest in sustainable technologies that can help reduce greenhouse gas emissions.

There are also a few crowdfunding platforms that are specifically focused on carbon capture and climatech. One example is Carbon Clean Solutions, which has raised millions of dollars from investors to develop its technology for capturing carbon dioxide from industrial processes.

Another is Ecoligo, which finances solar energy projects in emerging markets, providing a clean energy source that can help mitigate climate change.

Overall, the potential for crowdfunding to finance carbon capture and climatech projects is significant. According to a report from the World Bank, the global crowdfunding market is expected to reach $90 billion by 2025, with environmental and social causes among the most popular areas for investment.

This suggests that there is a growing appetite among retail investors for sustainable technologies and projects that can make a positive impact on the environment.

Carbon capture and climatech crowdfunding provides a tool for a vast array of investors to make a positive impact on the environment

In conclusion, carbon capture and climatech represent an important opportunity for investors looking to make a positive impact on the environment.

While traditional financing methods may be out of reach for early-stage startups in these fields, crowdfunding provides a viable alternative that can allow retail investors to get involved.

With the growth of crowdfunding platforms focused on environmental and sustainability projects, it’s clear that there is significant interest and potential for this approach to provide a pathway for innovative ideas and technologies to reach the market.

Retail and other investors who are interested in making a difference while potentially earning a return on their investment should take a closer look at the opportunities available in carbon capture and climatech crowdfunding.